My 52 Week Money Challenge

Are you planning to save money? Reach your financial goals this year by doing this 52 Week Money Challenge. Depending on how much save every week, you might end up saving significant amount.

New Year’s is the time for new resolutions and why not start thinking about financial planning.

Festival season is about to start, and you may want to create yourself a budget for shopping, so it would be a great idea to start thinking about how you’d like to shape your new year financially.

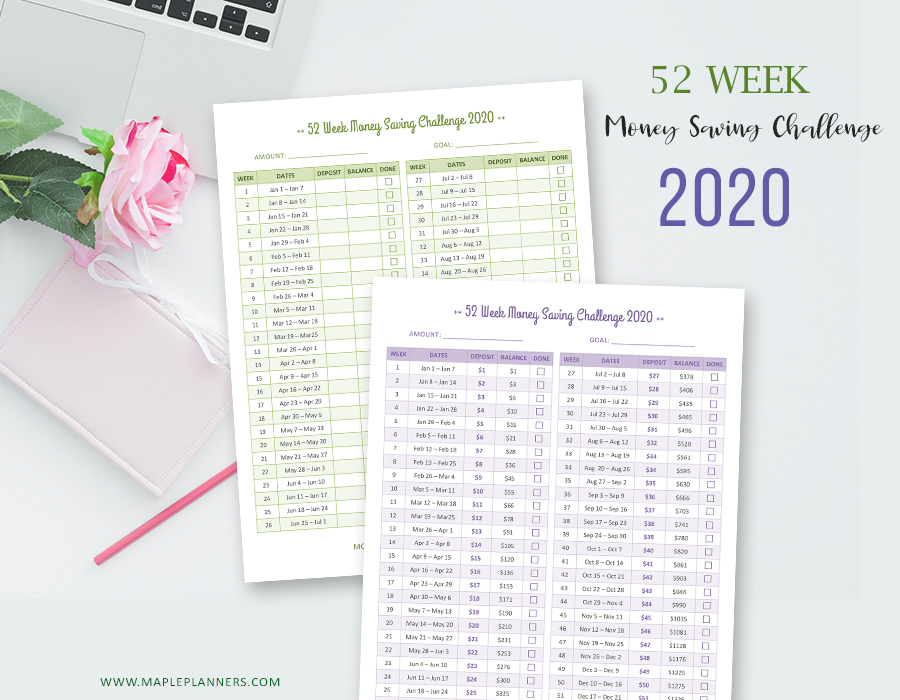

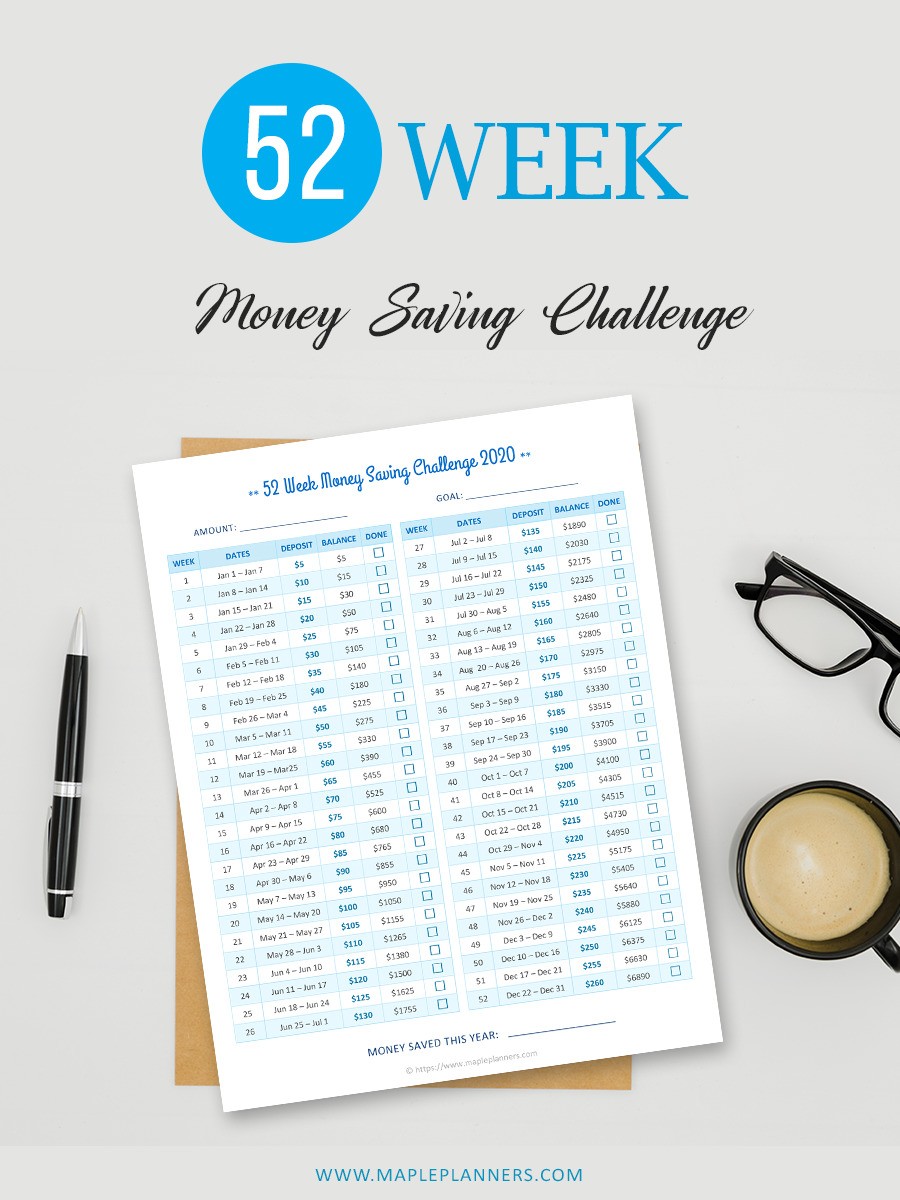

52 Week Money Saving Challenge

52 Week Money Saving Challenge is one of the great ways to start saving money. These challenges may seem challenging but easily doable.

With such money saving challenges, you get to decide the amount of money you want to save every week.

There are $1, $2, $5 or $10 increments that can be tried to see how big you can save each week.

It may seem pretty challenging, but challenge is what we are looking for, right?

Related: How to save money on groceries

This is how it works , in case you’re reading / hearing this for the first time. 52 Week Money Saving Challenge is perfect to save money over a period of time.

You save a certain amount of money each week. Because you save in smaller amounts, you don’t feel the pressure to save big, all at once.

So, you decide the amount, there is no hard and fast rule. Idea is to put aside some money every week.

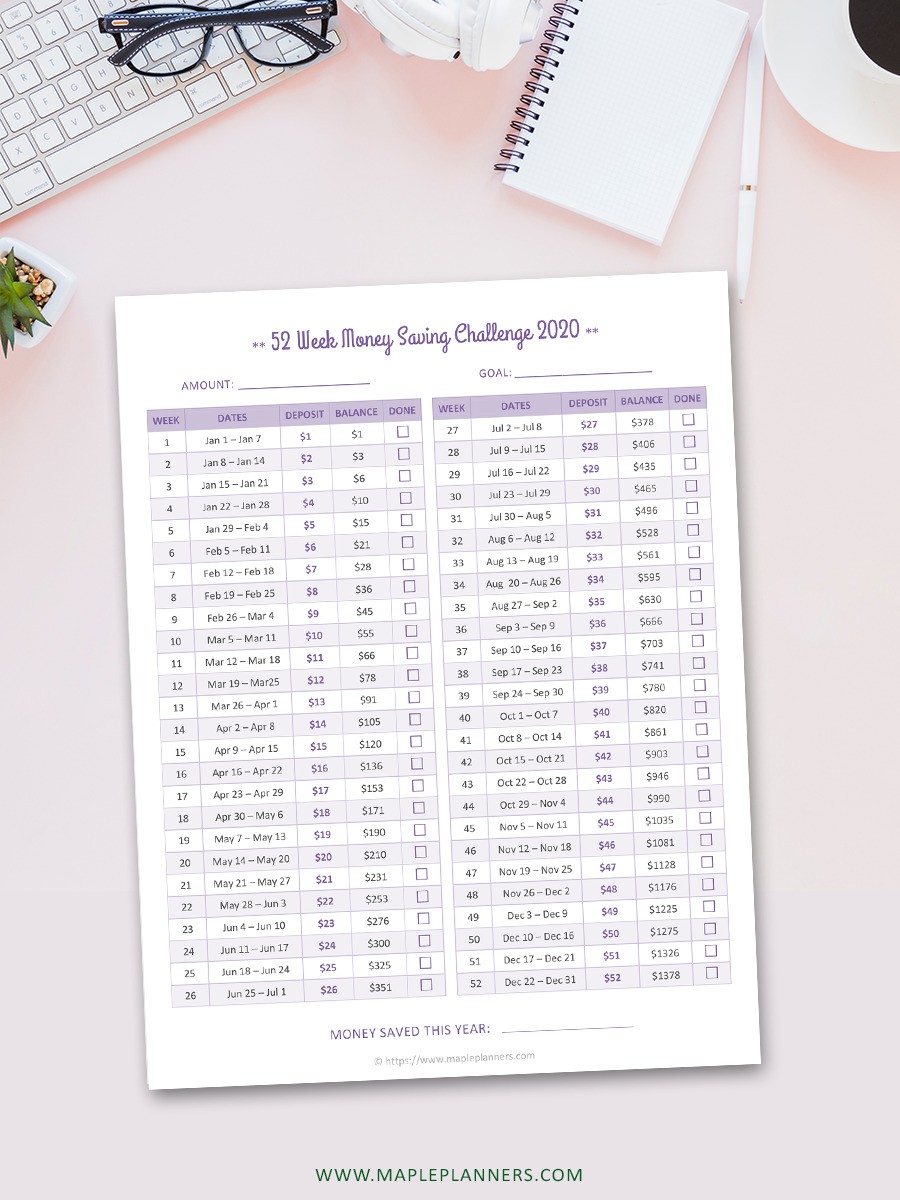

To keep track of how much you’re putting every week, you can write down the numbers on a sheet of paper, or print this 52 Week Money Saving Challenge template.

Once you decide the amount, simply print the copy, and start saving. When you have put the money away, simply check off that row.

You can set up a money jar, or even a savings account in your bank.

Because amount you want to use for every week is totally up to you, you can start from $1 or even go up to $50.

You should be fairly comfortable with the amount you want to use, because the way this system works is, you are going to have huge amount that needs to be saved towards the end of the year.

Related: Simple Way to Keep your Budget under Control

That time also happens to be around December and Christmas. Time when most of us find ourselves on tight budget. So to make most of this system, if you want you can reverse the chart and start your year from the amount you are supposed to save at the end of the year.

Or you can put away the most amount in the middle of the year, when you think your expenses won’t add up too much.

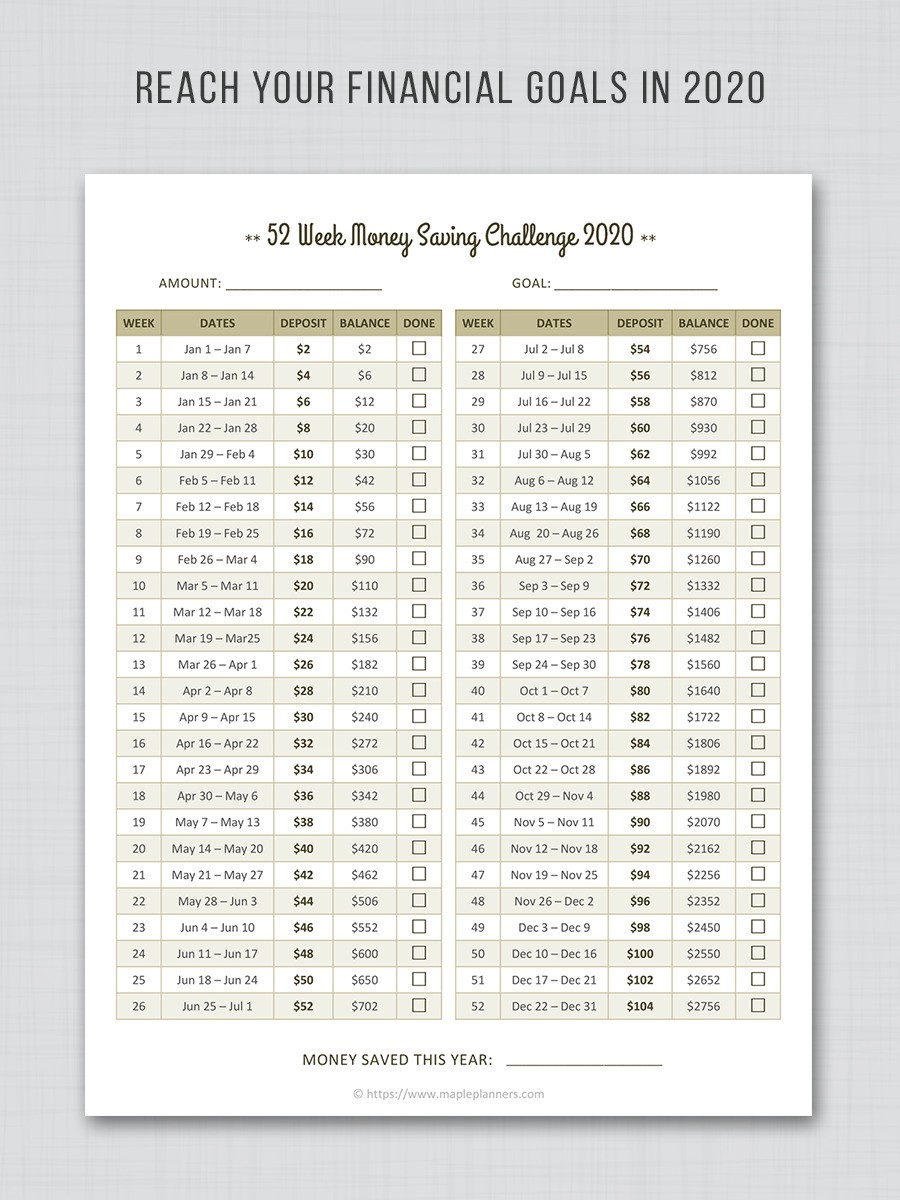

You can save the increments of $2 each week. You will end up saving $2700 at the end of 2020. Not bad, right?

This is how reversing the template and amount works:

Let’s say, you wish to go with $1 increments, the amount you will be putting in your savings account will be $52, next week will be $51 and so on. You can also pick any amount from other weeks, save that much in your account and mark that week as done. Simple!

Here’s the $5 increment version, where you will save increments of $5 each week. You will be able to save $6800 by the end of the year.

If you wish to use your own amounts, I’ve designed this empty template. You can go with any number each week. It’s very flexible and you are not obligated to save the fixed amount.

Here’s the version for empty template.

So, are you ready to save money in 2020? Come, let’s see if we can reach our respective set financial goals in 2020. Please share how much you are planning to save in the coming weeks and months. Let’s say Goodbye to unwanted and unexpected expenses and say Hello to savings, and more savings!